An Unbiased View of Estate Planning Attorney

An Unbiased View of Estate Planning Attorney

Blog Article

9 Easy Facts About Estate Planning Attorney Explained

Table of ContentsSome Of Estate Planning AttorneyThe 8-Second Trick For Estate Planning AttorneyGet This Report on Estate Planning AttorneyEstate Planning Attorney Can Be Fun For Anyone

Estate planning is an action plan you can use to determine what happens to your assets and obligations while you live and after you die. A will, on the other hand, is a lawful record that outlines how assets are distributed, that takes treatment of youngsters and pets, and any various other dreams after you pass away.

The administrator also has to settle any kind of tax obligations and debt owed by the deceased from the estate. Lenders generally have a limited amount of time from the date they were informed of the testator's fatality to make cases against the estate for cash owed to them. Cases that are rejected by the executor can be taken to court where a probate judge will have the last word regarding whether the case stands.

The Best Strategy To Use For Estate Planning Attorney

After the supply of the estate has actually been taken, the value of possessions calculated, and tax obligations and financial debt repaid, the executor will after that look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any estate tax obligations that are pending will certainly come due within nine months of the date of death.

Each specific areas their possessions in the trust fund and names a person besides their spouse as the beneficiary. A-B trusts have become less popular as the estate tax obligation exemption functions well for a lot of estates. Grandparents may transfer assets to an entity, such as a 529 plan, to sustain grandchildrens' education and learning.

The Greatest Guide To Estate Planning Attorney

Estate coordinators can collaborate with the contributor in order to reduce gross income as an outcome of those contributions or create methods that make the most of the impact of those donations. This is another strategy that can be utilized to restrict death taxes. It includes a private locking in the current value, and hence tax obligation obligation, of their building, while connecting the worth of future growth of that resources to one more person. This technique includes freezing the value of an asset at its worth on the date of transfer. As necessary, the amount of prospective resources gain at death is likewise iced up, allowing the anonymous estate coordinator to estimate their possible tax obligation responsibility upon death and far better strategy for the settlement of revenue taxes.

If adequate insurance policy profits are available and the plans are properly structured, any type of income tax obligation on the deemed personalities of assets adhering to the death of a person can be paid without resorting to the sale of properties. Earnings from life insurance coverage that are received by the recipients upon the death of the insured are normally income tax-free.

There are certain files you'll require as component of the estate preparation procedure. Some of the most usual ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is only for high-net-worth individuals. Estate intending makes it simpler for individuals to determine their wishes prior to and after they pass away.

Some Known Factual Statements About Estate Planning Attorney

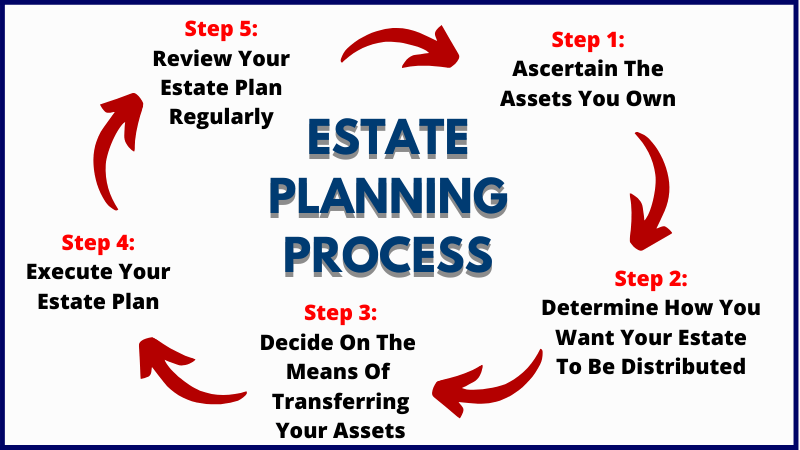

You should begin planning for your estate as soon as you have any type of quantifiable asset base. It's a continuous process: as life progresses, your estate plan should shift to match your circumstances, in line with your brand-new goals.

Estate planning is often believed of as a tool for the well-off. Estate planning is likewise a wonderful method for you to lay out strategies for the treatment of your minor children and pets discover here and to outline your wishes for your funeral and favored charities.

Eligible applicants that pass the test will certainly be formally certified in August. If you're qualified to sit for the test from a previous application, you may submit the brief application.

Report this page